The supply of items you can buy for pets is beyond imagination. Soap bubbles for cats, popcorn and beer kits for dogs, swimming goggles, and plenty of wearable digital gadgets are just a few examples of items that serve to supply an apparent-ly insatiable target group of “pet parents”.

Our pets are viewed more and more as important members of the family and many pet owners refer to themselves as pet parents. The inclusion of dogs and cats as fully-fledged family members means that the owners are willing to spend an increasingly large part of the household income on pet products.

No matter what product pet owners are looking for, options that speak to human interest are becoming the norm. Humans are doing the buying and they are more likely to buy something they relate to or find attractive. The paradigm of humanizing pets is clearly reflected in the many new product launches of pet food products promoting human grade ingredients.

Pet food manufacturers and retailers all around the world are busy devising new product categories that appeal to pet parents and the increasing humanization of pets.

Clean, natural and premium are among the most prominent claims in dog and cat food/snacks. Millennials and subsequent generations appear more motivated by healthy living and wellness as opposed to indulgence and pampering (Innova Market Insights).

Nutritious options take the lead in cat snacks NPD

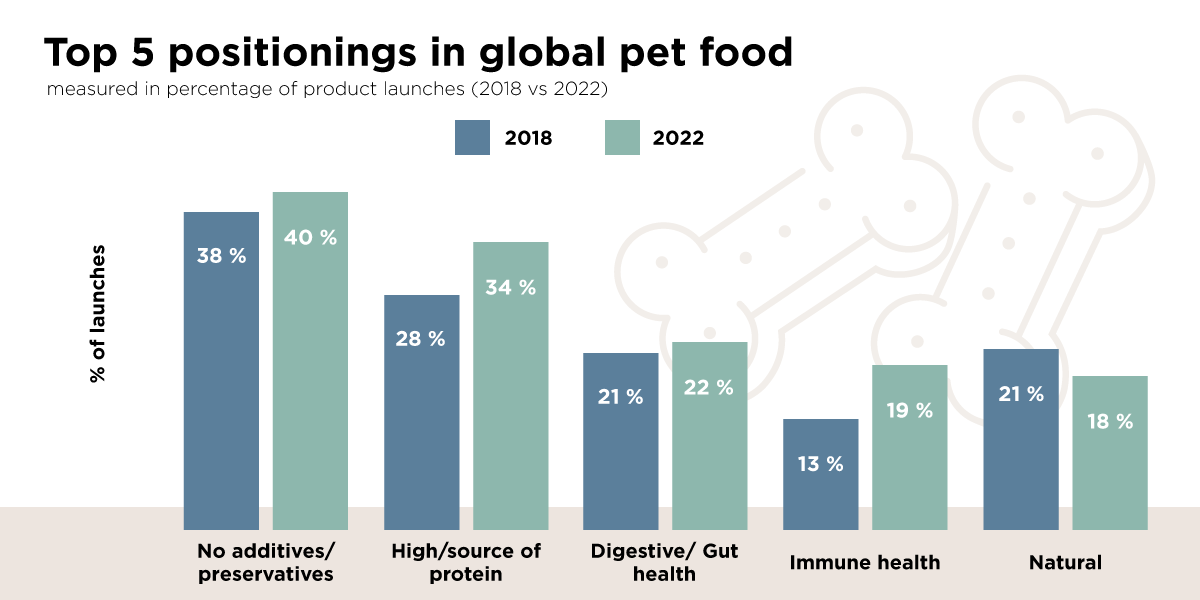

With pets regarded as part of the family, their food requirements are often similar to those for the human members, and similar positionings are used.

The desire to feed cats with nutritious options is driving NPD growth in the cat snack category (6 % CAGR; 2018 - 2022). There was also a rise in growth in pet food ingredients that carried specific health claims, the most popular being joint health, weight management, and aging well for pet’s longevity and quality of life. (Innova Market Insights, 2022)

High/source of protein is gaining prominence

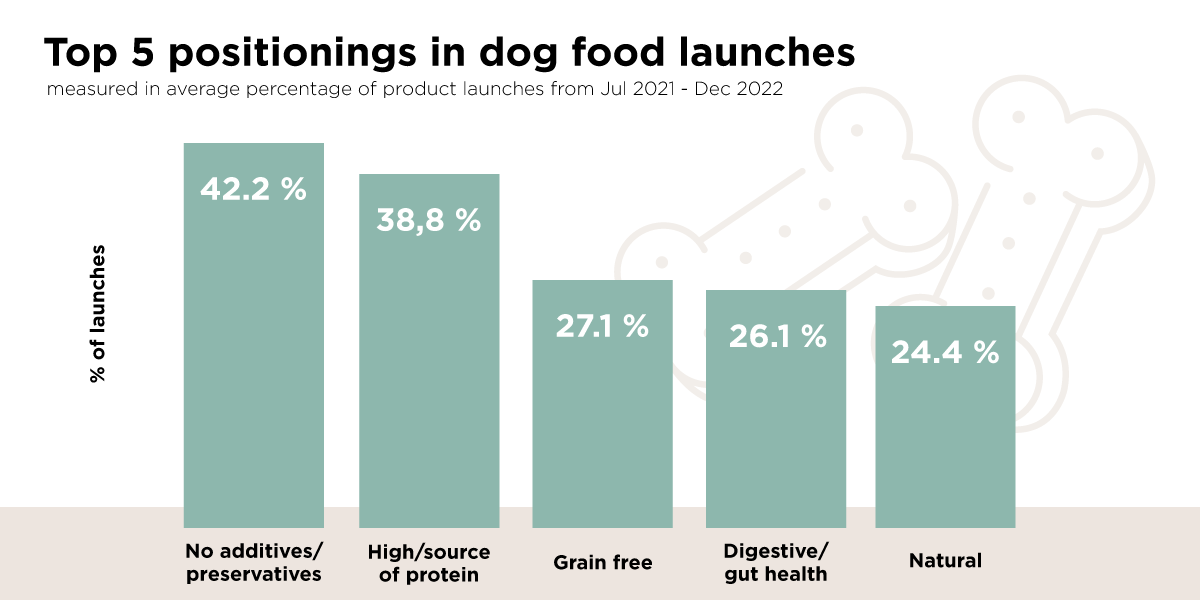

Humanization drives premiumization of dog food and snacks

Although traditional meat and poultry flavors continue to dominate NPD within dog food, nowhere is the move towards humanization more evident than in the rising use of options traditionally associated with human foods. Premiumization and gourmet meals, organic claims, balanced and holistic nutritional claims (bone health, immunity, oral health) and innovative flavors are highlights for wet pet food launches in H2 2022.

Dry pet food follows suit with trending claims, where nutritious clean label, novel protein sources, grain free, gluten free, light formulations and options to tackle obesity are stimulating growth.

Dog snacks/treats is the leading subcategory

Animal protein flavors are continuing to dominate global pet food NPD category, despite an interest in diversifying into plant-based ingredients and formulations. Novel flavor innovation is growing with sausage flavored treats leading with + 30,3 % GAGR from 2017 - 2022

Variety of formats and textures (chewy, baked, jerkies, moist), home-style launches, innovation from small companies, probiotic claims, weight management and dental health claims and novel flavors (such as gouda cheese, nori, spirulina, chamomile) are powering growth in the dog snack category.

The grain-free claim is growing

Dog snacks/treats display the highest NPD growth

The subcategory displays both the highest NPD share in Jul 2021 – Dec 2022 and growth (CAGR 2020 –2022 +6,9 %) in North America).

Appealing formats (cookies, bones, sticks), texture variations (crunchy, chewy) and health claims (oral health, digestive/gut health, rich/source of protein, vitamins/minerals fortified) promote the launches. (Innova insights 2023)

Protein solutions can work for you

Our range of human grade protein solutions can do a lot to improve the quality and nutritional value of pet food products. In addition to adding protein, they are clean label ingredients that deliver other functionalities such as added flavor, texture and yield. Make some inquiries about co-creating to find out how we can help optimize your pet food recipe. Take the first step by contacting a representative near you.

If you want to know more about how you can pursue different pet food opportunities using our human grade ingredients, please contact your local Essentia representative or use our ingredient guide with specific focus on pets.